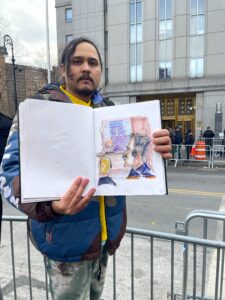

Photo courtesy of @freeelizabeth_ / Instagram.

August and September marked a time of new opportunities for communities like Passaic, Elizabeth and Hudson County’s Hoboken after its members made their voices heard through organizing and petitioning to lower rent caps and enforce affordable housing set-asides.

This comes with the help of other New Jersey counties who also stepped up to the plate with increasing development for low and moderate income units.

The Jersey Escrow is a series where we keep you up-to-date on affordable housing information. Here’s a roundup of housing news from this past summer.

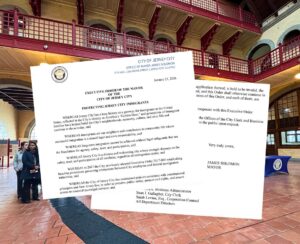

Restored $20 Rent Cap for Elizabeth And Lower Rent Cap for Passaic

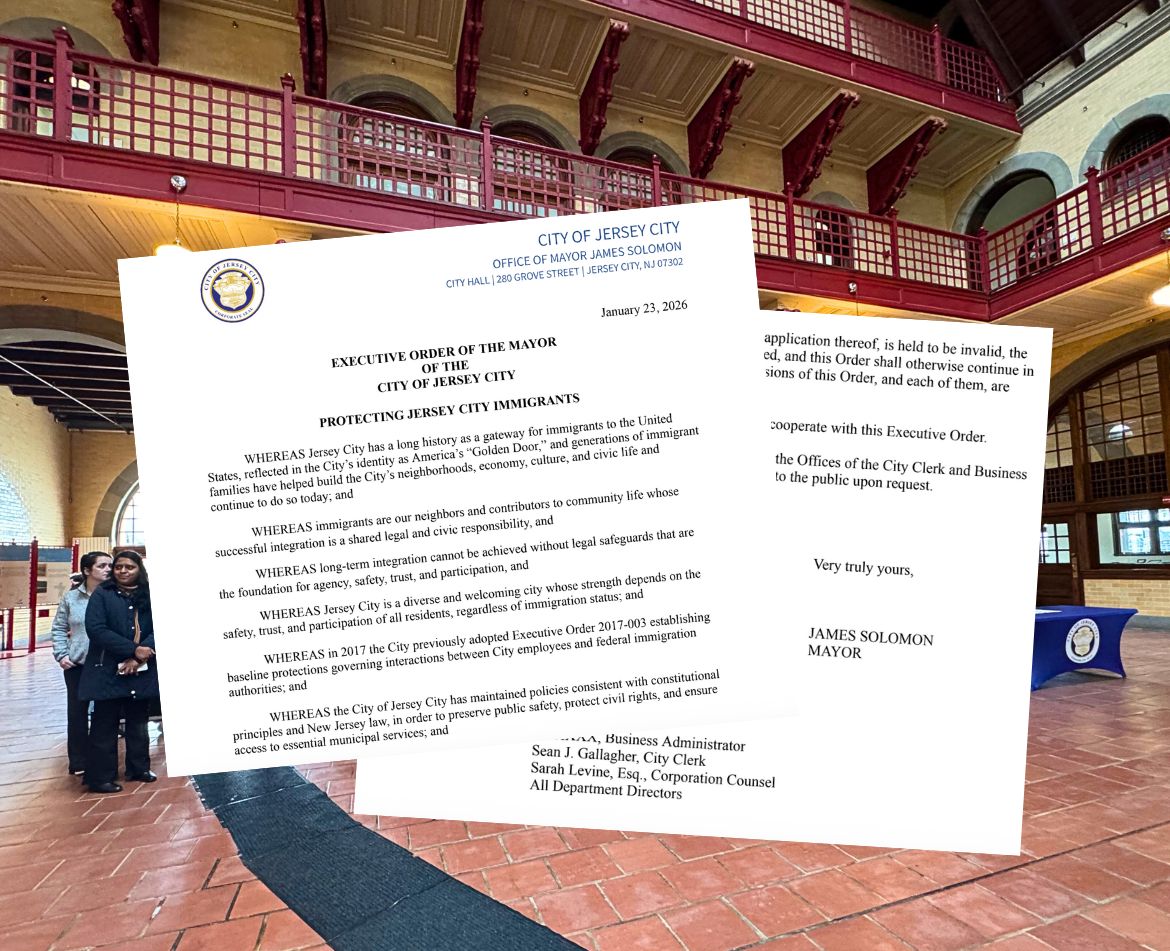

After Fair Rent and Enfranchise Elizabeth and North Jersey Democratic Socialists of America empowered the community to organize, the Elizabeth City Council restored Ordinance 6160, which was originally removed in 2022. The ordinance reads that rent cannot be increased for more than $20 or 3% annually.

Similarly, Passaic City Council unanimously voted to lower their annual rent cap from 6% to 3% in September after organizing and petitioning from the Passaic community and Make the Road NJ. Make The Road New Jersey is an organization based in Elizabeth that focuses on empowering and assisting the Latinx community by hosting information sessions and events statewide.

Passaic and Elizabeth are home to large immigrant communities, who are celebrating the win. According to the city of Passaic, a significant amount of Passaic residents are foreign born; somewhere around 70% as of 2025. “Nearly half” of Elizabeth’s residents are immigrants, according to Elizabeth’s website.

Editor’s note: Due to the government shutdown, Slice of Culture does not have access to the U.S. Census, which provides information such as race/ethnicity, income, education and poverty levels of a municipality. We are collaborating with municipalities and fellow journalists to find alternatives that are reliable and accurate as the shutdown continues.

Once information is once again accessible from the U.S. Census, we will update this article.

Hoboken Developers Must Set Aside Affordable Housing Units After 13-Year Legal Battle

In 2012, Fair Share Housing sued multiple Hoboken developers for not setting aside 10% of units for low and moderate income housing.

In 2025, Hudson County Judge Joseph Turula ruled that three developers cannot rent any new units until they comply. The lawsuit originally included four developers, but The Harlow settled with Fair Share Housing last December, agreeing to add 14 affordable units in a new project.

Now, these buildings must comply by:

- VINE must add 13 affordable units, with at least eight two-bedroom units and two three-bedrooms units.

- Park + Garden must add 21 affordable units, with at least 12 two-bedroom units and four three-bedroom units.

- Artisan of Clinton must add six affordable units, with at least four two-bedroom units and one three-bedroom unit.

These units must have 25% allocated for low-income, and the remaining 75% for moderate income.

In Hoboken, these incomes are considered to be: very-low-income, low-income and moderate income. The town’s average median household income in 2023 was $176,943 according to The Census Reporter.

- 30% or less; about $53,000 a year

- 50% or less; about $88,471 a year

- More than 50% but less than 80%; about $88,547 to $141,554 a year

Editor’s Note: Due to the government shutdown, Slice of Culture is not able to obtain current census data. This number may be higher or lower in 2025. The Census Reporter is a trusted source by journalists and journalism organizations.

New Jersey government and nonprofit organizations offer a number of affordable housing resources. You can find some here:

- New Jersey Housing Resource Center

- Affordable Housing Alliance

- Housing and Community Development Network of New Jersey

- Fair Share Housing

Know any New Jersey housing news or resources we should include? Email Chelsea Pujols at [email protected].